SOL Price Prediction: Is the Current Dip a Buying Opportunity?

#SOL

- Technical indicators show SOL may be oversold with MACD turning bullish

- Market sentiment is mixed with negative headlines but positive ecosystem developments

- The current price level offers potential entry point for long-term investors

SOL Price Prediction

SOL Technical Analysis: Key Indicators Point to Potential Rebound

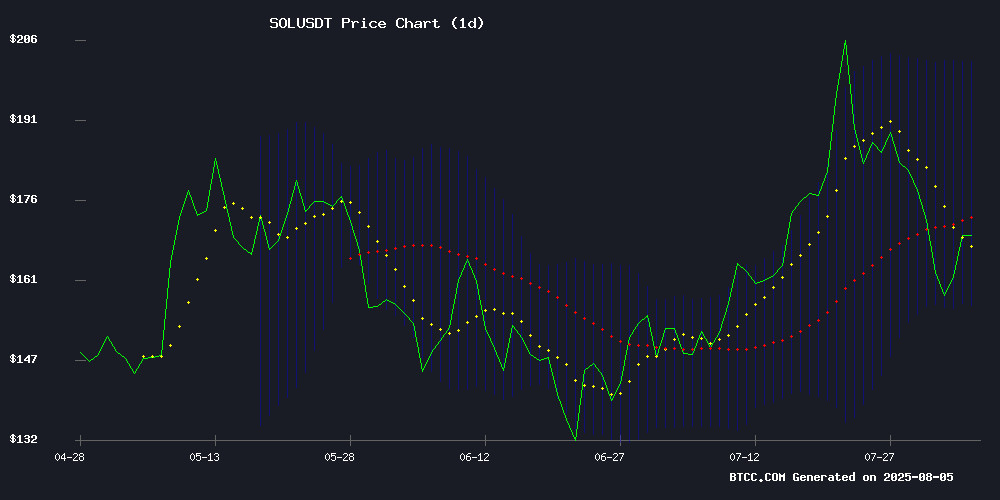

SOL is currently trading at $167.29, below its 20-day moving average of $179. The MACD shows bullish momentum with a positive histogram (11.7961), while Bollinger Bands suggest the price is NEAR the lower band ($156.20), indicating potential oversold conditions. 'When SOL approaches the lower Bollinger Band with MACD turning positive, we often see mean reversion,' says BTCC analyst Olivia.

Market Sentiment Mixed Amid Solana Ecosystem Developments

While Phantom Wallet's acquisition of Solsniper shows ecosystem growth, the 25% price drop and Pump.fun's revenue decline reflect short-term bearish sentiment. 'Negative headlines are creating buying opportunities for long-term investors,' notes BTCC's Olivia. The technical setup suggests this could be a favorable entry point.

Factors Influencing SOL's Price

Pump.fun Revenue Plummets 80% Amid Memecoin Market Downturn

Solana-based memecoin launchpad Pump.fun recorded its weakest performance of 2025 in July, with revenue collapsing to $24.96 million—an 80% drop from January's $130 million peak. The platform's decline mirrors a broader contraction in the memecoin sector, where market capitalization fell 23.5% to $65 billion and trading volume cratered 67% to $5.59 billion.

Daily active traders on Pump.fun dwindled to 129,000, down 62% from earlier highs, while trading volume slipped 56% to $150 million. Solana's new token creation hit a three-month low, with just 34,040 SPL tokens minted on August 2. Even LetsBonk's 25% trader increase couldn't offset shrinking trade sizes, as volumes fell 10%.

The revenue collapse follows a steady erosion throughout 2025—from $90 million in February to $37 million in March, then stabilizing near $40 million before July's breakdown. This trajectory aligns with fading speculative fervor across crypto markets, particularly for meme-based assets that dominated Q1 activity.

Solana (SOL) Price: Could This 25% Drop Be The Perfect Buying Opportunity?

Solana has plunged more than 25% from its July peak of $206, now hovering near $162 as market volatility shakes out speculative positions. The Layer 1 token's retreat mirrors broader crypto market weakness, though technical analysts spot potential accumulation zones between $136-$148 where institutional buyers previously emerged.

Key support levels loom at $160 and $120, with resistance clustered near $175. Market participants debate whether this correction represents healthy consolidation after SOL's 2025 rally or signals deeper bearish momentum. The RSI and MACD indicators currently hover in neutral territory, offering no clear directional bias.

Long-term projections remain bullish, with price targets between $200-$300 by year-end 2025. Solana's fundamental strengths - including growing developer activity and institutional adoption - continue attracting believers despite short-term price action.

Phantom Wallet Expands Solana Ecosystem with Acquisition of Solsniper Trading Platform

Phantom, the dominant cryptocurrency wallet for the Solana blockchain, has acquired Solsniper, an AI-powered trading platform specializing in Solana memecoins. The deal, announced August 5, 2025, accelerates Phantom's transformation from a wallet into a comprehensive trading and analytics hub.

Solsniper's lightning-fast tools for monitoring new tokens and tracking wallets have made it a favorite among power users in Solana's high-speed ecosystem. The acquisition follows Phantom's $150 million Series C funding round earlier this year, which valued the company at $3 billion.

"They are one of the best teams in crypto," Phantom CEO Brandon Millman said of Solsniper's developers in a post on X. The Solsniper web platform will continue operating independently as Phantom integrates its technology.

Is SOL a good investment?

Based on current technicals and market developments, SOL presents an interesting risk/reward scenario:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $167.29 | 25% below recent highs |

| 20-day MA | $179.00 | Potential resistance |

| Bollinger Bands | $156.20-$201.80 | Near lower band |

| MACD | Bullish crossover | Positive momentum |

'The combination of oversold technicals and ecosystem growth makes SOL attractive for dollar-cost averaging,' suggests BTCC's Olivia.

1